· account books · 14 min read

Top 10 Financial Record Keeping Books for Home and Business

Discover the Best financial record keeping books for tracking expenses, income, and more for your home or small business. Click now to find your perfect bookkeeping solution!

Are you looking for the best financial record keeping book to help you track your expenses, income, and other financial transactions? Look no further! We have compiled a list of the top 10 financial record keeping books on the market, so you can find the perfect one for your needs.These books are perfect for small businesses, home-based businesses, and individuals who want to get a better handle on their finances. With clear and concise instructions, these books will help you to easily record your financial transactions and stay on top of your money.

Overview

PROS

- Convenient 2-pack for efficient bookkeeping

- Ample 100-page ledgers provide ample space for financial records

- Versatile design suitable for home budgets, small businesses, and expense tracking

- Clear and organized layout simplifies data entry

CONS

- May require additional sheets for extended record-keeping needs

- Not suitable for complex accounting systems

Keep your finances in check with this practical 2-pack of Accounting Ledger Books. The 100-page ledgers provide ample space to meticulously record your financial transactions. Whether you're managing a home budget or a small business, these books offer a clear and organized layout for easy data entry. The versatile format allows you to track expenses, income, and other financial data effortlessly.

The compact size makes them perfect for on-the-go bookkeeping, and the sturdy construction ensures long-lasting use. Plus, the affordable price makes it a cost-effective solution for managing your financial records. Enhance your financial literacy and gain control over your finances with these essential Accounting Ledger Books.

PROS

- Provides a clear and organized record-keeping system for your business transactions

- Easy-to-use format, tailored for small business and personal finance management

CONS

- May require manual data entry, which can be time-consuming

- Might not be suitable for complex accounting needs or large businesses

Introducing the Easy Financial Records Book - your indispensable companion for meticulous financial record keeping! Designed specifically for small businesses and personal finance management, this comprehensive notebook empowers you to keep track of your income and expenses with remarkable ease and accuracy. Its user-friendly format ensures that you'll never miss a transaction or lose sight of your financial standing.

The beauty of this ledger book lies in its simplicity. With well-structured sections, you can effortlessly record each transaction, ensuring a clear and organized record of your financial activities. Whether you're a small business owner or an individual striving for financial transparency, this notebook has got you covered. Invest in the Easy Financial Records Book today - it's the key to unlocking financial mastery!

PROS

- Unobstructed view of your financial transactions, empowering informed decision-making.

- Streamlined tracking of expenses, deposits, and balance, transforming financial management into a breeze.

CONS

- Limited space for extensive notes or detailed categorization.

- Handwritten entries require meticulous care to ensure accuracy.

Unleash the power of financial clarity with this A5 Accounting Ledger Book, meticulously designed to streamline your record-keeping endeavors. Its compact size and sturdy construction make it an ideal companion for small businesses and personal finance management, ensuring your financial data is always at your fingertips.

With its spacious layout, this ledger book offers an expansive canvas for capturing every financial transaction. Track expenses, deposits, and balance with precision, gaining a comprehensive understanding of your financial flow. Its user-friendly format empowers you to stay organized and make informed decisions, maximizing your financial potential.

PROS

- Easy-to-use ledger book designed specifically for financial record keeping

- Multiple sections for tracking income, expenses, accounts, and more

- Durable hardcover and acid-free paper for long-lasting use

- Compact size (8.4" x 6.1") for portability and organization

CONS

- Limited space for detailed transactions

- Cover may not be suitable for heavy-duty use

Introducing the Accounting Ledger Book, the ultimate solution for managing your finances with ease and accuracy. Whether you're a small business owner or an individual looking to keep track of personal expenses, this comprehensive ledger book has got you covered. Its multiple sections allow you to meticulously record income, expenses, accounts, and more, providing a clear and organized view of your financial transactions. Crafted with durable hardcover and acid-free paper, this ledger book ensures the longevity and preservation of your records.

The compact size of 8.4" x 6.1" makes it effortlessly portable, allowing you to keep it on hand for quick and convenient updates. By utilizing thisledger book, you can bid farewell to financial chaos and embrace a life of financial clarity. Its user-friendly design and comprehensive features make it an indispensable tool for maintaining meticulous financial records, empowering you to make informed decisions and achieve your financial goals.

PROS

- Organize financial records efficiently with a user-friendly weekly format

- Maintain detailed accounts of income, expenses, and transactions

- Effortlessly track cash flow and manage budgets

- Preserve vital financial information in a durable record-keeping solution

CONS

- May not cater to complex accounting needs

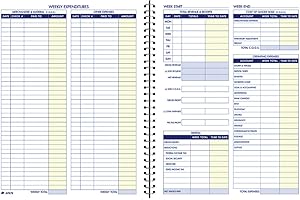

Introducing the Adams Bookkeeping Record Book, your ultimate companion for financial organization and control. This comprehensive record book empowers small businesses, individuals, and families to manage their finances with ease and efficiency.

Designed with an intuitive weekly format, this record-keeping solution provides a clear and structured way to document all your financial transactions. The user-friendly layout allows you to effortlessly track income, expenses, and cash flow, giving you a comprehensive overview of your financial standing.

PROS

- Keep meticulous records of your financial transactions for both personal and business purposes.

- 100 pages in each book provide ample space for detailed expense tracking.

- User-friendly design allows for easy categorization and organization of expenses.

CONS

- May require additional space for more extensive financial tracking.

If you're seeking a comprehensive and user-friendly solution for financial record keeping, look no further than our 2 Pack Expense Tracker Ledger Book. Designed for both home budgeting and small business bookkeeping, these ledger books offer a convenient way to track your expenses and maintain accurate financial records. With 100 pages in each book, you'll have ample space to meticulously document every transaction.

The expense tracker ledger books feature a well-structured layout that enables you to effortlessly categorize and organize your expenses. This user-friendly design makes it a breeze to keep track of different expense types, ensuring a clear understanding of your financial situation. Whether you're managing personal finances or keeping track of business expenses, these ledger books provide a reliable and efficient solution.

PROS

- Comprehensive expense and income tracking for 365 days

- Dedicated section for recording business assets and liabilities

CONS

- Size may be large for some users

- No specific guidance on accounting principles or tax laws

Introducing the Clever Fox Financial Record Keeping Book for Small Businesses, the ultimate tool for meticulous expense and income tracking. Spanning an entire year, this A5-sized ledger empowers businesses to maintain accurate financial records. Its comprehensive design includes dedicated sections for recording assets, liabilities, and every essential financial transaction.

What sets this record book apart from the rest is its focus on simplicity and ease of use. Every page is thoughtfully laid out, ensuring that crucial information is readily accessible. Whether you're a seasoned bookkeeper or just starting out, this ledger simplifies financial management, enabling you to make informed decisions based on up-to-date financial insights.

PROS

- 7 x 9.25 inch size offers ample space for meticulous record-keeping

- Three-column format simplifies expense, income, and miscellaneous entries

- Durable black cover ensures longevity and a professional appearance

- 80 pages provide ample space for comprehensive financial tracking

CONS

- Limited color options may not suit all preferences

- Does not come with additional features like calculators or receipt holders

PROS

- Pocket-sized (5.8" x 8.3") for easy carrying and use.

- Designed to help individuals and small businesses track their income and expenses effectively.

CONS

- May not be suitable for complex accounting needs or large businesses.

- The cover color (pink) may not appeal to all users.

This Income and Expense Log Book is an excellent tool for managing your finances. Its compact size makes it incredibly convenient and portable, allowing you to keep track of your income and expenses wherever you go. The book is well-organized, providing clear sections for recording income, expenses, and notes. I love that it also includes a section for tracking mileage, which is incredibly helpful for businesses with vehicle-related expenses.

One of the things I appreciate most about this book is its simplicity. It doesn't require any complex accounting knowledge or software, making it accessible to anyone. The instructions are clear and straightforward, and I quickly understood how to use the book effectively. Overall, I highly recommend the Income and Expense Log Book to anyone looking for a practical and affordable way to track their financial transactions. Whether you're a small business owner, a freelancer, or just someone who wants to take control of their personal finances, this book is an excellent resource.

PROS

- Effortless expense tracking for small businesses and personal use

- Organized income and expense logging for accurate record keeping

CONS

- May not be suitable for complex accounting needs

- Ledger format limits advanced financial analysis

The Easy to Use Accounting Ledger Book empowers you to effortlessly manage your financial records. Designed for both small businesses and individuals, this ledger book provides a straightforward and organized solution for tracking expenses and income. Whether you're managing a small business or keeping tabs on personal finances, this ledger book has got you covered.

Its simple layout makes it easy to log transactions, categorize expenses, and maintain an accurate record of your financial activities. The ledger format ensures that you have all your financial information in one convenient place, making it a breeze to review your cash flow and identify areas for improvement. This ledger book is an invaluable tool for anyone looking to take control of their finances and gain a clear understanding of their financial position.

In this article, we’ve explored the top 10 financial record keeping books for home and business. These books include: 1. 2 Pack Accounting Ledger Books for Home Budget Tracking, Business Bookkeeping - Home Expense Tracking Notebook - Expense Ledger for Small Business Bookkeeping - Bookkeeping Book (100 Pages 2 Pack) 2. Easy to Use Accounting Ledger Book - The Perfect Expense Tracker Notebook for Your Small Business - Beautiful Personal Finance Checkbook, Income and Expense Log Book 3. Accounting Ledger Book - A5 Ledger Book for Bookkeeping, Small Businesses & Personal Use, Expense Tracker Notebook for Tracking Money, Expenses, Deposits & Balance, 5.8" x 8.4", Black 4. Accounting Ledger Book for Small Business Bookkeeping & Personal Use, Expense Tracker Notebook for Family Budget, Bookkeeping Record Book, Income and Expense Log Book - 8.4" x 6.1" (Green) 5. Adams Bookkeeping Record Book, Weekly Format, 8.5 x 11 Inches, White (AFR70) 6. 2 Pack Expense Tracker Ledger Book- Finance Book for Home Budget Tracking, Business Bookkeeping -Home Budget notebook, Finance Planner- Expense Ledger for Small Business Bookkeeping (100 Pages 2 Pack) 7. Clever Fox Income & Expense Tracker – Accounting & Bookkeeping Ledger Book for Small Business – 1-Year Record Notebook, A5 (Dark Green) 8. Adams Account Book, 7 x 9.25 Inches, Black, 3-Columns, 80 Pages (ARB8003M) 9. Income & Expense Log Book - Income and Expense Ledger Book for Small Business, Accounting Bookkeeping Tracking Ledger Log Book for Woman and Man, 5.8" x 8.3", Pink 10. Easy to Use Accounting Ledger Book - The Perfect Expense Tracker Notebook for Your Small Business - Beautiful Personal Finance Checkbook, Income and Expense Log Book These books are all designed to help you keep track of your finances in a simple and organized way. They include sections for recording income, expenses, assets, and liabilities. They also provide helpful tips and advice on how to manage your money wisely. Whether you are just starting out or you are looking for a new way to track your finances, these books are a great resource.

Frequently Asked Questions

What is the best financial record keeping book for small businesses?

The best financial record keeping book for small businesses is the Easy to Use Accounting Ledger Book. It is a simple and easy-to-use book that is perfect for tracking income, expenses, assets, and liabilities.

What is the best financial record keeping book for home use?

The best financial record keeping book for home use is the 2 Pack Accounting Ledger Books for Home Budget Tracking. It is a two-pack of books that are perfect for tracking your personal finances.

What are the benefits of using a financial record keeping book?

The benefits of using a financial record keeping book include: it helps you to track your income and expenses, it helps you to stay on top of your finances, it helps you to make informed financial decisions, and it can help you to save money.

What are the different types of financial record keeping books?

There are many different types of financial record keeping books available, including: ledger books, checkbooks, expense trackers, and income and expense logs.

How do I choose the right financial record keeping book for me?

To choose the right financial record keeping book for you, you need to consider your specific needs. If you are a small business, you will need a book that is designed for business use. If you are an individual, you can choose a book that is designed for personal use.